LNG Exports Driving US Natural Gas Infrastructure

US exports of liquified natural gas are a rapidly growing driver of new American infrastructure investment. The reason: global energy shortages have caused demand and prices for LNG to skyrocket. This has put US LNG in an extremely favorable export position, because of our plentiful supplies and low cost of natural gas to feed our export terminals, relative to other producing and exporting countries.

The price of natural gas in Europe and Asia has tripled and quadrupled over the past several months, while US prices have "only" doubled, presenting a large opportunity to US producers and exporters. It seems that new foreign customers' long-term LNG supply contracts with US exporters are being announced weekly, limited only by our export capacity, which is also set to expand rapidly.

Beyond the immediate bullish picture, there's an even brighter long-term outlook stemming from growing Asian demand. According to the Global Energy Monitor, Asian countries today have almost $400 billion of natural gas infrastructure under construction or planned. About half of that is for new natural gas power plants, and the other half is split between new LNG import terminals and the pipelines needed to deliver the gas to the new plants.

These new plants represent a doubling of current Asian gas-fired generating capacity, adding the equivalent of all current gas-fired capacity in Europe and Russia, and increasing total global gas-fired capacity by 20%.

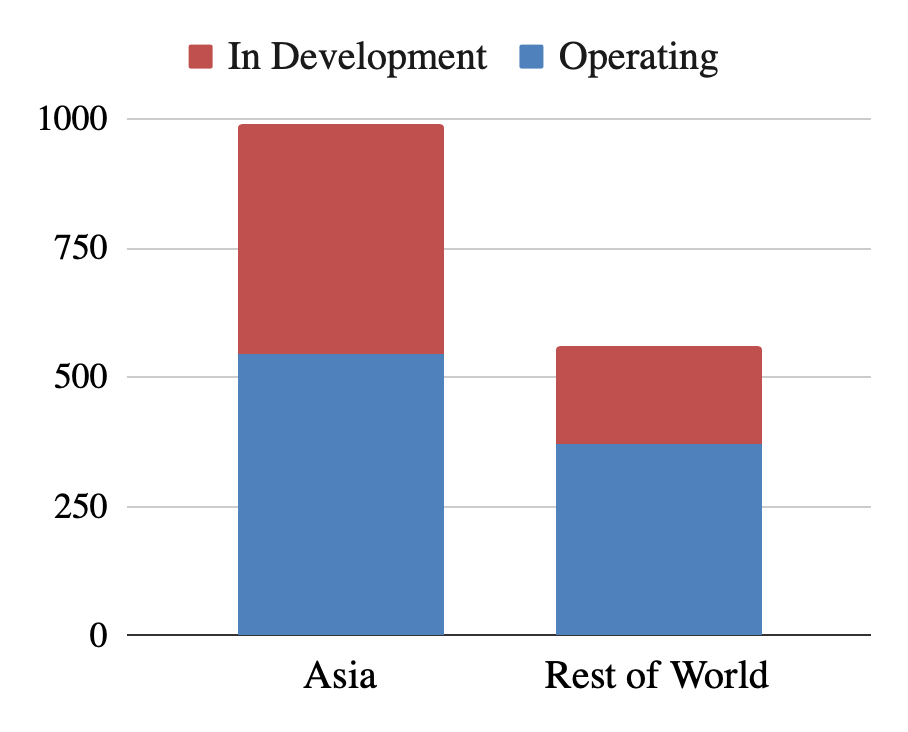

To feed these new generating plants, Asian LNG importers are now developing new import terminals that would nearly double their current import capacity of 550 million metric tons per annum (mtpa) to about 1,000 mtpa. That's the equivalent of adding about 60 billion cubic feet per day (bcf/d) of Asian natural gas consumption. How much of that could show up on American natural gas producers and exporters' order books? The answer depends on how much, and how fast, US export capacity can be built.

Import Capacity, Million Metric Tons Per Year of LNG

Source: Global Energy Monitor

To put it in context, thanks to shale, US natural gas production has grown to over 93 billion cubic feet, or bcf, per day. Of that total, we are now exporting about 12 bcf/d as LNG, which is currently 100% of our LNG export capacity. For perspective, as recently as six years ago that number was zero.

Roughly another 10 bcf/d of US capacity is now under construction or soon will be, most which should come online by 2025. While nearly all of this will be located on the Gulf Coast, it will be fed by natural gas pipelines still to be built, as well as by feed gas from the existing interstate pipeline network. Much of this prospective new LNG output has already been contracted for either by commodity traders or by major foreign energy companies.

Beyond this next wave of new capacity, there's a large number of proposed projects that have already been fully permitted by both FERC and the Department of Energy, but that have not yet secured the customer commitments to enable construction. In this tranche there is about another 25 bcf/d of capacity. If even one-third of that, or 8 bcf/d, is eventually built, we will still be exporting more than 30 bcf/d by the end of this decade. That means American natural gas would be able to fill up to one-half of the 60 bcf/d of new Asian demand.

To relate this to construction opportunity, it requires roughly about $4.5 billion of capital investment to build one billion cubic feet per day of LNG export capacity, a majority of which goes into construction. So 18 bcf/d of additional capacity represents $80 billion of investment.

Not only is there a huge construction market opportunity in building both the new export terminals and their connecting pipelines, but also in the supply chain opportunities that support the shale production complexes that will be needed to drill for that much more natural gas. That's along with the gathering lines, compression, storage, and processing and all the rest of the upstream infrastructure needed for production.

So we're optimistic about the future of natural gas infrastructure far into the future. Even if US domestic consumption levels off, substantial production growth will be driven by new global demand, not only from the developed and developing economies of the world, but also from the vast potential coming from places like Africa and South Asia that are trying to escape from energy poverty and/or shift away from coal in favor of cleaner burning fuels.

|

|